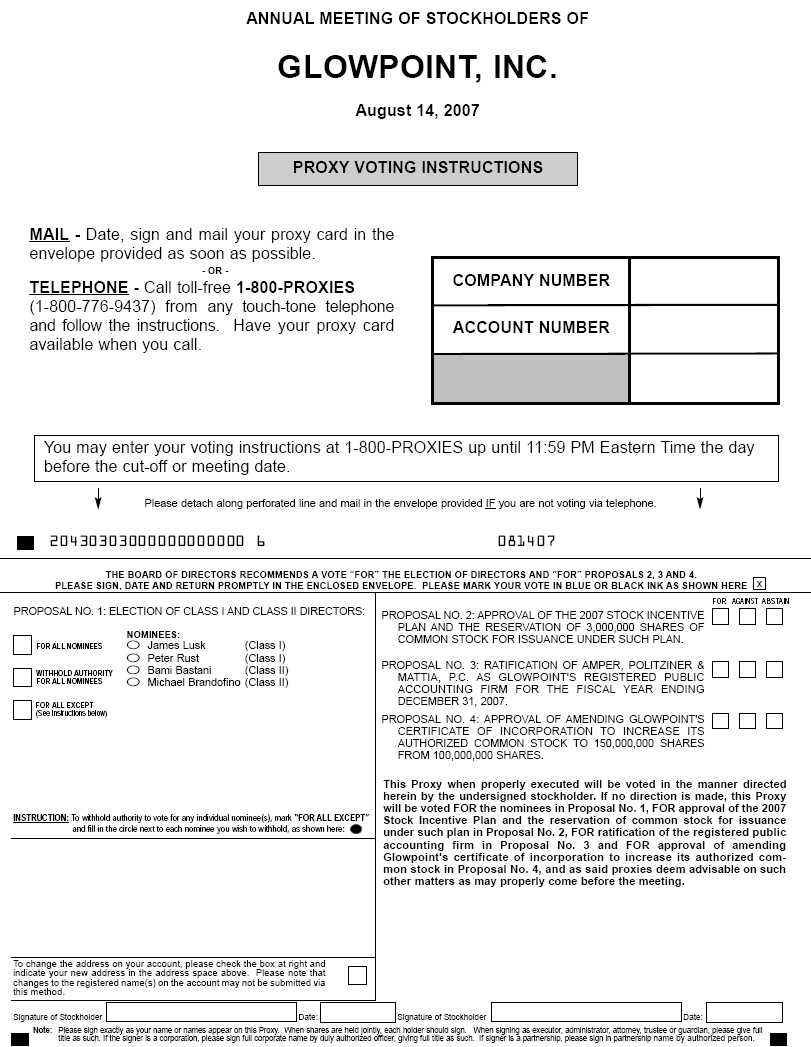

Stockholders have the option to vote by telephone. WE ENCOURAGE YOU TO RECORD YOUR VOTE BY TELEPHONE. It is convenient, and it saves significant postage and processing costs. In addition, when you vote by phone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted.

After you have submitted a proxy, you may change your vote at any time before the proxy is exercised by submitting a notice of revocation or a proxy bearing a later date. Regardless of whether you voted using a traditional proxy card or by telephone, you may use either of these methods to change your vote. You may change your vote either by submitting a proxy card prior to the date of the Annual Meeting or by voting again prior to the time at which the telephone voting facilities close by following the procedures applicable to those methods of voting. In each event, the later submitted vote will be recorded and the earlier vote revoked. You may also revoke a proxy by voting in person at the Annual Meeting. Your attendance at the Annual Meeting will not by itself constitute revocation of a proxy.

We will bear the cost of the solicitation of proxies from our stockholders, including the cost of preparing, assembling and mailing the proxy solicitation materials. In addition to solicitation by mail, our directors, officers and employees may solicit proxies from stockholders by telephone or other electronic means or in person, but no such person will be specifically compensated for such services. We will cause brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of stock held of record by such persons. We will reimburse such custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in doing so. We have engaged American Stock Transfer and Trust Company to aid in the distribution of the proxy materials and will reimburse the related reasonable out-of-pocket expenses.

STOCKHOLDER PROPOSALS

Any stockholder who intends to present a proposal at the 20082010 Annual Meeting of Stockholders, currently expected to occur in May 2008,2010, must deliver the proposal to the Corporate Secretary, Glowpoint, Inc., 225 Long Avenue, Hillside, New Jersey 07205, no later than JanuaryDecember 31, 20082009 if such proposal is to be considered for inclusion in our proxy materials for that meeting.

In addition, our by-laws provide that, in order for a stockholder to propose business for consideration at an annual meeting of stockholders, the stockholder must give written notice to our Corporate Secretary at our principal executive offices not less than 60 days nor more than 90 days prior to the anniversary date of the immediately preceding annual meeting of stockholders; provided however, that in the event the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the stockholder in order to be timely must be received not later than the close of business on the 10th day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date the annual meeting was made, whichever occurs first.

QUESTIONS AND ANSWERS ABOUT THE 20072009 ANNUAL MEETING

Q:

What Is The Proposal Relating To Amending The Certificate To Declassify The Board?

A:

Currently, our board is divided into three classes and each class serves three year terms. You will be asked to consider and vote upon a proposal to instead elect all directors annually for one year terms.

Q:

What Is The Proposal Relating To The Election Of Directors That I Will Be Voting On At The Annual Meeting?

A:

You will be asked to consider and vote upon a proposal to elect individuals to the board of directors. Depending on whether the amended certificate of incorporation is approved (Proposal 1), you will either be asked to elect five directors to serve a one-year term or elect two Class I Directors to serve a three-year term each. Specifically, you will be asked to elect either (i) the following five individuals to a one-year term: Joseph Laezza, James S. Lusk, David W. Robinson, Peter A. Rust and Grant Dawson; or (ii) the following two individuals to a three-year term: James S. Lusk and Peter A. Rust.

Q:

What Is The Proposal Relating To The Ratification Of The Audit Committee’s Appointment Of an Independent Registered Public Accounting Firm That I Will Be Voting On At The Annual Meeting?

A:

You will be voting to ratify the audit committee’s appointment of Amper, Politziner & Mattia, LLC, an Independent Registered Public Accounting Firm, as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2009.

Q:

Who Is Soliciting My Proxy?

A:

This proxy solicitation is being made and paid for by Glowpoint. In addition to this solicitation by mail, proxies may be solicited by our directors, officers and other employees by telephone, Internet or fax, in person or otherwise. Such persons will not receive any additional compensation for assisting in the solicitation. We will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of our common stock. We will reimburse such persons and our transfer agent for their reasonable out-of-pocket expenses in forwarding such material.

Q:

How Does The Board Recommend That I Vote On The Matters Proposed?

A:

Your board unanimously recommends that you vote “FOR” each of the proposals submitted at the Annual Meeting.

Q:

Who Is Entitled To Vote At The Annual Meeting?

A:

Only holders of record of our common stock as of the close of business on April 16, 2009 will be entitled to notice of and to vote at the Annual Meeting.

Q:

When And Where Is The Annual Meeting?

A:

The Annual Meeting of our stockholders will be held at 1:30 p.m. local time, on Tuesday, May 28, 2009, at the law offices of Gibbons P.C., One Gateway Center, 21st Floor, Newark, New Jersey 07102.

Q:

Where Can I Vote My Shares?

A:

You can vote your shares where indicated by the instructions set forth on the proxy card, including by telephone, or you can attend and vote your shares in person at the Annual Meeting.

Q:

If My Shares Are Held In “Street Name” By My Broker, Will My Broker Vote My Shares For Me?

A:

Your broker may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters. You should follow the directions provided by your broker regarding how to instruct your broker to vote your shares.

Q:

May I Change My Vote After I Have Mailed My Signed Proxy Card?

A:

Yes. Just send in a written revocation or a later dated, signed proxy card before the Annual Meeting or vote again by telephone, or simply attend the Annual Meeting and vote in person. Simply attending the Annual Meeting, however, will not revoke your proxy; you must vote at the Annual Meeting.

Q:

What Do I Need To Do Now?

A:

Please vote your shares as soon as possible so that your shares may be represented at the Annual Meeting. You may vote by signing and dating your proxy card and mailing it in the enclosed return envelope or by telephone, or you may vote in person at the Annual Meeting.

Q:

Who Should I Call If I Have Questions?

A:

If you have questions about any of the proposals on which you are voting, you may call David W. Robinson, our Corporate Secretary, at 866-GLOWPOINT (x2087).

PROPOSAL NO. 1 —

AMENDING CERTIFICATE OF INCORPORATION TO ELIMINATE CLASSIFIED BOARD OF DIRECTORS

Article Seventh of our Amended and Restated Certificate of Incorporation, as amended (the “Certificate”), currently provides that the board is divided into three classes and each class shall serve three year terms. The board of directors adopted a resolution to amend and restate Article Seventh of the Certificate so as to elect all directors annually and directors shall serve for one year and until their successors are duly elected and qualified. See Appendix A hereto for the Certificate of Amendment to the Amended and Restated Certificate of Incorporation of Glowpoint, Inc.

The board of directors has considered the merits of annually elected and staggered boards, taking into account a variety of perspectives. The board recognizes that a staggered board may make it more difficult or discourage an unsolicited tender offer, proxy contest or assumption of control by a holder of a large block of the Company’s shares, even in the event that any of these transactions are favored by the shareholders of the Company. Management is not currently aware of any specific effort to accumulate Glowpoint securities or otherwise obtain control of Glowpoint by means of a tender offer or proxy contest. In addition, the board recognizes that a staggered board may make the removal of incumbent management more difficult. The board believes that its staggered system has helped assure the continuity of experienced and seasoned directors and reinforced a commitment to the long-term point of view. Nonetheless the board believes that it would be equally effective under an annual system. Accordingly, the board has adopted a resolution to declassify the board of directors so as to elect all directors annually and directors will serve for one year and until their successors are duly elected and qualified.

Prior to this meeting, each director submitted his resignation, which was without disagreement and conditioned upon approval of this proposal. Therefore, if this proposal is approved, certain of the directors are standing for election at this meeting while other directors will resign and are not standing for election. If this proposal is not approved, the resignations will not be effective and only the class of directors whose term was expiring will stand for election (see Proposal 2).

Required Vote

An affirmative vote of a majority of the outstanding stock entitled to vote at the Annual Meeting in person or by proxy is required for the approval of the amendment and restatement of Article Seventh of the Certificate.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF THE CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION. PROXIES SOLICITED BY GLOWPOINT WILL BE VOTED IN FAVOR OF THIS PROPOSAL UNLESS SHAREHOLDERS SPECIFY IN THEIR PROXIES A CONTRARY CHOICE.

PROPOSAL NO. 2 —

ELECTION OF DIRECTORS

If Proposal 1 is Not Approved

Our directors are presently divided into three classes.classes and will continue to be divided into three classes if Proposal 1 is not approved. The number of directors is determined from time to time by our board of directors. A single class of directors is typically elected each year at the annual meeting of stockholders and each suchstockholders. Each director elected wouldat an annual meeting will serve for a term ending at the third annual meeting of stockholders after his or her election and until his or her successor is elected and duly qualified. Because we did

In the event Proposal 1 is not have a shareholders meeting last year, however,approved, only the Class I directors that would have beenDirectors are to be elected then continuedat the Annual Meeting. Those Class I Directors to be elected are to serve until their subsequent election, which will occur this year. In order to maintain the three year cycle of our classified Board terms, we will only elect those Class I directors to serve for a term ending at the second2012 annual meeting of stockholders after their election, which is the 2009 annual meeting, andor until their respective successors are duly elected and duly qualified. The Class II directors, whose term is expiring this year, will be elected for a term ending at the third annual meeting of stockholders after their election, which is the 2010 annual meeting, and until their successors are elected and duly qualified.

If Proposal 1 is Approved

If Proposal 1 is approved, the classes of directors will be eliminated and all directors are to be elected at the Annual Meeting. Those directors to be elected are to serve until the next annual meeting or until their respective successors are duly elected and qualified. The number of directors is determined from time to time by our board of directors and is currently six members. With the approval of Proposal 1 and the resignation of all of the directors, however, the size of our board of directors will be reduced to five members. The nominees who will stand for election are Joseph Laezza, James S. Lusk, David W. Robinson, Peter A. Rust and Grant Dawson, all of whom, except Mr. Dawson, are currently members of our board of directors. The five nominees receiving the highest number of affirmative votes will be elected as directors. In the event any nominee is unable or unwilling to serve as a nominee, the board of directors may select a s ubstitute nominee. If a substitute nominee is selected, proxies will be voted in favor of such nominee. Our board of directors has no reason to believe that any of the named nominees will be unable or unwilling to serve as a nominee or as a director if elected.

Director and Executive Officer Information

The following table sets forth information with respect to our current directors, director nominees and executive officers.

Name | Age | Position with Company | ||

Class I Director Nominees | ||||

James S. Lusk (1)(2) | 53 | Class I Director | ||

Peter A. Rust (1)(3)(4) | 55 | Class I Director | ||

All Other Director Nominees (if Proposal 1 is approved) | ||||

Joseph Laezza | 38 | Class III Director, | ||

David W. Robinson | 40 | Class III Director, Co-Chief Executive Officer, General Counsel, Executive Vice President, Business Development and Corporate Secretary | ||

Grant Dawson | 40 | Director Nominee | ||

Other Directors and Non-Director Executive Officer | ||||

Bami Bastani (1)(2)(3) | 55 | Class III Director | ||

Dean Hiltzik (2)(3) | 55 | Class III Director | ||

Edwin F. Heinen | 57 | Chief Financial Officer and Executive Vice President, Finance | ||

———————

(1)

Member of the Audit Committee.

(2)

Member of the Compensation Committee.

(3)

Member of the Nominating Committee.

(4)

Alternate Member of the Compensation Committee

Biographies

Class I Director Nominees

James S. Lusk, Class I Director.

Mr. Lusk joined our board of directors in FebruaryPeter A. Rust, Class I Director

. Mr. Rust joined our board of directorsAll Other Director Nominees

Joseph Laezza, Co-Chief Executive Officer, President and Class IIIII Director

telecommunications service providers, including AT&T and XO Communications, where he was responsible for operations, service delivery, and customer service.

David W. Robinson, Co-Chief Executive Officer, General Counsel, Executive Vice President of Business Development, Corporate Secretary and Class III Director. Mr. Robinson has been our Co-Chief Executive Officer and before that, served asClass III Director since March 2009, our Executive Vice President, Business Development since June 2008, and Chief Technology OfficerGeneral Counsel since October 2000.May 2006. His term as a Class III Director will expire at the annual meeting of stockholders in 2011. Prior to joining the Company, Mr. Robinson was Vice President and General Counsel of Con Edison Communications from August 2001 until March 2006, when Con Edison Communications was purchased by RCN Corporation. Before that, Mr. BrandofinoRobinson served in senior executive positions with other telecommunications service providers and provided legal and business counseling to other businesses. Mr. Robinson received a B.A. from the University of Pennsylvania (magna cum laude) and a Juris Doctorate from Boston College Law School.

Grant Dawson, Director Nominee. Mr. Dawson is Senior Investment Analyst, North American Fixed Income, for MFC Global Investment Management, with responsibility for credit assessment and recommendations related to MFC GIM’s fixed income assets that are managed against industry benchmarks. He joined MFC Global Investment Management in 2008 and has worked in the investment industry since 1998. Previously, he was co-foundera lead analyst with a credit rating agency and Presidenthas held various senior management positions in credit management and corporate finance with Nortel and in equity research with Dain Rauscher Ltd. Mr. Dawson earned an M.B. A. from the SMU Cox School of Johns Brook Co.Business, a B.A. and a Bachelor of Commerce from the University of Windsor, and is a Chartered Financial Analyst. Mr. Dawson is “independent” (in accordance with the published listing requirements of the NYSE AMEX LLC) and has been determined by the board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules. In the event Proposal 1 is approved and he is elected to the board, Mr. Dawson is expected to be elected by the board to the audit and compensation committees to fill the vacancy created by the resignation of Dr. Bastani and Mr. Hiltzik, respectively. Mr. Dawson was originally brought to the attention of the nominating committee pursuant to Section 3.9(c) of that certain Series A-1 Convertible Preferred Stock Purchase Agreement, dated as of March 16, 2009 (the “Purchase Agreement”), Inc.,which provides that the nominating committee will consider one board nominee proposed by a technology consulting company acquired by us in 2000.purchaser thereto and so long as such purchaser owns at least 50% of the outstanding shares of Series A-1 Convertible Preferred Stock. The purchaser under the Purchase Agreement, Vicis Capital, LLC, satisfies this criteria and submitted Mr. Brandofino holds a B.S. degree in Management Information Systems from Pace University.

Required Vote and Board Recommendation

A plurality of the votes duly cast is required for the election of directors. This means that the nominees receiving the highest number of affirmative votes will be elected to fill the director positions available. Votes withheld from any nominee are counted for purposes of determining the presence or absence of a quorum, but have no other legal effect. Stockholders do not have the right to cumulate their votes in the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF EACH NOMINEE FOR DIRECTOR NAMED ABOVE.

Additional Biographies

Directors, Whose Terms of Office Continue After the Annual Meeting if Proposal 1 is not approved

Bami Bastani, Class III Directors

Dean Hiltzik, Class III Director.

Mr. Hiltzik has been a member of our board of directors since May 2000 and his term will expire at the annual meeting of stockholders inJoseph Laezza, Co-Chief Executive Officer, President and Class III Director

.David W. Robinson, Co-Chief Executive Officer, General Counsel, Executive Vice President of Prime Communications, an Avaya Business Partner that installs technologically advanced communication systems for businesses of all sizes. Mr. Reiss previously served as Chairman of our board from May 2000 to December 2006Development, Corporate Secretary and served as our Chief Class III Director. See above.

Executive Officer from May 2000 to October 2003. Mr. Reiss also served as our President from May 2000 to April 2002. Mr. Reiss served as Chairman of the Board of Directors, President and Chief Executive Officer of ACC from ACC’s formation in 1991 until the formation of Glowpoint’s predecessor pursuant to the merger of ACC and View Tech, Inc. (VTI) in May 2000.

The following individuals are ourindividual is an executive officersofficer but areis not directors:

Edwin F. Heinen, Chief Financial Officer and Executive Vice President, Finance.

Mr. Heinen, a certified public accountant, has been our Chief Financial Officer since April 2006 and previously served as our Controller since March 2005. Mr. Heinen joined the Company from Communications Network Enhancement, Inc., an audio conferencing company, where he was CFO since September 2001. Before that, Mr. Heinen served in senior financial executive positions with responsibility for accounting, auditing, treasury, analysis, budgeting, and financial and tax reporting. Mr. Heinen received a B.S. in Business Administration from Cornell University and an M.B.A in Finance from the University of Detroit.Board of Directors, Board Committees and Meetings

Corporate governance is typically defined as the system that allocates duties and authority among a company’s stockholders, board of directors and management. The stockholders elect the board and vote on extraordinary matters; the board is the company’s governing body, responsible for hiring, overseeing and evaluating management, particularly the chief executive officer; and management runs the company’s day-to-day operations. The primary responsibilities of the board of directors are oversight, counseling and direction to our management in the long-term interests of us and our stockholders. Our board of directors currently consists of seven directors. The current board members and nominees for election include five independent directors and one current member and one former member of our senior management.

Our board of directors met ten times during the year ended December 31, 2006.2008. During this period, each director other than Michael Toporek attended or participated in more than 75% of the aggregate of (i) the total number of meetings of the board of directors held during the period for which he or she was a director and (ii) the total number of meetings of committees of the board on which he or she served, held during the period for which he or she served. The board has an audit committee, a compensation committee and a nominating committee.

As a general matter, board members are expected to attend our annual meetings. We did not, however, have anAll of our Board members attended our 2009 annual meeting of stockholders in 2006.

“Independent” Directors.Directors. Each of our directors and director nominees other than Messrs. ReissLaezza and BrandofinoRobinson qualify as “independent” in accordance with the published listing requirements of the American Stock ExchangeNYSE AMEX LLC (“AmEx”). Mr. Brandofino is a current employeeMessrs. Laezza and Mr. Reiss was an employee until December 31, 2006.Robinson are currently our employees. The AmEx independence definition includes a series of objective tests, such as that the director is not an employee of the company and has not engaged in various types of business dealings with the company. In addition, as further required by the AmEx rules, the board has made a subjective determination as to each independent director that no relationship exist which, in the opinion of the board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and the company with regard to each director’s business and personal activities as they may relate to Glowpoint and Glowpoint’s management.

In addition, as required by AmEx rules, the members of the audit committee each qualify as “independent” under special standards established by the Securities and Exchange Commission (the “SEC”) for members of audit committees. The audit committee is also required to have at least one independent member who is determined by the board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules, including that the person meets the relevant definition of an “independent director.” Each member of the audit committee is independent and has been determined to be an audit committee financial expert. Stockholders should understand that this designation is a disclosure requirement of the SEC related to these directors’ experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon these directors any duties, obligationsobl igations or liability that are greater than are generally imposed on them as a member of the audit committee and the board, and their designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the audit committee or the board.

Audit Committee

We currently have an audit committee consisting of James S. Lusk (Chairman), Bami Bastani and Peter A. Rust. James Spanfeller resigned from the audit committee in May 2006 and Mr. Rust was appointed as his replacement. Aziz Ahmad was appointed an alternate member of the audit committee in June 2006. Karen Basian and Michael Toporek resigned from the audit committee in December 2006 and Dr. Bastani and Mr. Lusk were appointed as their replacements. Our board of directors has determined that each member of the audit committee has the accounting and related financial management expertise and satisfies the requirement as an “audit committee financial expert,” all as determined pursuant to the rules and regulations of the SEC. The audit committee consults and meets with our Independent Registered Public Accounting Firm and chief financial officer and accounting personnel, reviews potential conflict of interest situations where

appropriate, and reports and makes recommendations to the full board of directors regarding such matters. The audit committee operates under a written audit committee charter, which was originally filed with our proxy statement for the 2003 annual meeting of our stockholders, but was amended and restated by the board on September 29, 2005. Our amended and restated audit committee charter is available online atwww.glowpoint.com/governance.governance. You may also request a copy of the audit committee charter, at no cost, by telephoning us at (866) GLOWPOINT or writing to us at Glowpoint, Inc., 225 Long Avenue, Hillside, New Jersey 07205, Attention: Investor Relations. The audit committee met sixfive times during the year ended December 31, 2006.

Compensation Committee

We currently have a compensation committee consisting of Bami Bastani, Dean Hiltzik and James S. Lusk. Since June 2006, Aziz Ahmad and Peter Rust each serveserves as an alternate membersmember of the compensation committee. Karen Basian and Michael Toporek resigned from the compensation committee in December 2006 and Dr. Bastani and Mr. Lusk were appointed as their replacements. Each member of the compensation committee meets the independence requirements of the AmEx. The compensation committee is responsible for supervising our executive compensation policies, reviewing officers’ salaries, approving significant changes in employee benefits and recommending to the board of directors such other forms of remuneration as it deems appropriate. The compensation committee operates under a written compensation committee charter, which was adopted in May 2007 and is available online atwww.glowpoint.com/governance.governance. You may also request a copy of the compensation committee charter, at no cost, by telephoning us at (866) GLOWPOINT or writing to us at Glowpoint, Inc., 225 Long Avenue, Hillside, New Jersey 07205, Attention: Investor Relations.Relatio ns. The compensation committee met three timesfive during the year ended December 31, 2006.

Nominating Committee

We currently have a nominating committee consisting of Bami Bastani, Dean Hiltzik and Peter A. Rust. James Spanfeller resigned from the nominating committee in May 2006 and Mr. Rust was appointed as his replacement. Aziz Ahmad was appointed an alternate member of the nominating committee in June 2006. Michael Toporek resigned from the nominating committee in December 2006 and Dr. Bastani was appointed as his replacement. Each member of the nominating committee meets the independence requirements of the AmEx. The nominating committee is responsible for assessing the performance of our board of directors and making recommendations to our board regarding nominees for the board. The nominating committee was formed in February 2004. Prior to the formation of the committee, its functions were performed by the board of directors. The nominating committee operates under a written nominating committee charter, which was filed with our proxy statement for the 2004 annual meeting of our stockholders and is available online atwww.glowpoint.com/governance.governance. You may also request a copy of the nominating committee charter, at no cost, by telephoning us at (866) GLOWPOINT or writing to us at Glowpoint, Inc., 225 Long Avenue, Hillside, New Jersey 07205, Attention: Investor Relations.

The nominating committee considers qualified candidates to serve as a member of our board of directors suggested by our stockholders. Stockholders can suggest qualified candidates for director by writing to our Corporate Secretary at 225 Long Avenue, Hillside, New Jersey 07205. Stockholder submissions that are received in accordance with our by-laws and that meet the criteria outlined in the nominating committee charter are forwarded to the members of the nominating committee for review. Stockholder submissions must include the following information:

A statement that the writer is our stockholder and is proposing a candidate for our board of directors for consideration by the nominating committee;

·

The name of and contact information for the candidate;

·

A statement of the candidate’s business and educational experience;

·

Information regarding each of the factors set forth in the nominating committee charter sufficient to enable the nominating committee to evaluate the candidate;

·

A statement detailing any relationship between the candidate and any of our customers, suppliers or competitors;

·

Detailed information about any relationship or understanding between the proposing stockholder and the candidate; and

·

A statement that the candidate is willing to be considered and willing to serve as our director if nominated and elected.

In considering potential new directors and officers, the nominating committee will review individuals from various disciplines and backgrounds. Among the qualifications to be considered in the selection of candidates are broad experience in business, finance or administration; familiarity with national and international business matters; familiarity with our industry; and prominence and reputation. The nominating committee will also consider whether the individual has the time available to devote to the work of our board of directors and one or more of its committees. NoneOther than Mr. Dawson, who was recommended by Vicis Capital LLC in accordance with the Purchase Agreement, none of the candidates this year for election to the board of directors were brought to the nominating committee by stockholder submission.

The nominating committee will also review the activities and associations of each candidate to ensure that there is no legal impediment, conflict of interest, or other consideration that might hinder or prevent service on our board of directors. In making its selection, the nominating committee will bear in mind that the foremost responsibility of a director of a corporation is to represent the interests of the stockholders as a whole. The nominating committee will periodically review and reassess the adequacy of its charter and propose any changes to the board of directors for approval.

Director Compensation

Our current director compensation policy provides that directors who are not our executive officers or employees receive a director’s fee of a cash payment of $2,000 and an option to purchase 1,000 shares of common stock for each board meeting attended, a cash payment of $1,000 and an option to purchase 500 shares of common stock for each committee meeting attended, and a cash payment of $5,000 and options to purchase 4,000 shares of common stock for attendance at the annual meeting of stockholders. Each chairperson of a standing committee of our board of directors also receives a cash payment of $1,000 per year, paid following each annual meeting of our stockholders. Attendance at board meetings and committee may be in person or by telephone.

At the Annual Meeting, our board of directors has decided to adopt a new director compensation policy, which will provides that directors who are not our executive officers or employees receive an annual cash fee of $20,000, payable in equal quarterly installments on the first business day following the end of the calendar quarter, and an annual grant of 25,000 restricted shares of our common stock, which shall be made at the annual meeting of our stockholders and shall vest at the next annual meeting of our stockholders. The chairperson of our board of directors, if any, and the chairperson of our audit committee will each receive an additional cash payment of $5,000 per year, payable in equal quarterly installments. Attendance at board meetings and committee may be in person or by telephone.

The following table represents compensation paid to our directors during the year ended December 31, 2006:

Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Option Awards (3) | Total | |||||||||

| Aziz Ahmad | $ | 6,000 | $ | 11,590 | $ | 862 | $ | 18,452 | |||||

| Karen Basian | 21,000 | 29,833 | 3,848 | 54,681 | |||||||||

| Dean Hiltzik | 23,000 | 42,400 | 4,189 | 69,589 | |||||||||

| Peter Rust | 12,000 | 14,118 | 1,748 | 27,866 | |||||||||

| James Spanfeller | 6,000 | - | 1,412 | 7,412 | |||||||||

| Michael Toporek | 18,000 | - | 3,628 | 21,628 | |||||||||

Name |

| Year |

| Fees Earned or Paid in Cash (1) |

| Stock Awards (2) |

| Option Awards (3) |

| Total |

| ||||

Aziz Ahmad |

| 2008 |

| $ | 21,000 |

| $ | 7,600 |

| $ | 4,869 |

| $ | 33,469 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Bami Bastani |

| 2008 |

|

| 35,000 |

|

| 14,000 |

|

| 7,579 |

|

| 56,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Dean Hiltzik |

| 2008 |

|

| 24,000 |

|

| — |

|

| 5,355 |

|

| 29,355 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

James Lusk |

| 2008 |

|

| 35,000 |

|

| 14,000 |

|

| 7,378 |

|

| 56,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Richard Reiss |

| 2008 |

|

| 25,000 |

|

| — |

|

| 5,701 |

|

| 30,701 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Peter Rust |

| 2008 |

|

| 31,000 |

|

| 12,338 |

|

| 6,788 |

|

| 50,126 |

|

———————

(1)

Non employee directors are paid $2,000 for attending each Board of Director meeting and $1,000 for attending each committee meeting.

(2)

When a non-employee is elected to the Board of Directors they receive 80,000 restricted shares which vest as to 20,000 shares on each of the grant date and first, second and third anniversary dates of the grant. The amounts included in the “Stock Awards” column represent the compensation cost we recognized in 20062008 related to non-option stock awards, as described in Statement of Financial Accounting Standards No. 123R without taking into account any forfeiture rates. For a discussionWe value the non-option stock awards using the common stock price of the valuation assumptions, see Note 13 to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2006.grant date. Please see the “Grants of Plan-Based Awards” table for more information regarding stock awards we granted in 2006.2008. The table below summarizes, by year of grant, the 2006 expense amounts reported in the “Stock Awards” column for each named executive officer:

Name | 2003 | 2004 | 2005 | 2006 | Total | |||||||||||

| Aziz Ahmad | $ | - | $ | - | $ | - | $ | 11,590 | $ | 11,590 | ||||||

| Karen Basian | 29,833 | - | - | - | 29,833 | |||||||||||

| Dean Hiltzik | - | 42,400 | - | - | 42,400 | |||||||||||

| Peter Rust | - | - | - | 14,118 | 14,118 | |||||||||||

Name |

| Year |

| 2006 |

| 2007 |

| 2008 |

| Total |

| ||||

Aziz Ahmad |

| 2008 |

| $ | 7,600 |

| $ | — |

| $ | — |

| $ | 7,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bami Bastani |

| 2008 |

|

| — |

|

| 14,000 |

|

| — |

|

| 14,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dean Hiltzik |

| 2008 |

|

| — |

|

| — |

|

| — |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jim Lusk |

| 2008 |

|

| — |

|

| 14,000 |

|

| — |

|

| 14,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard Reiss |

| 2008 |

|

| — |

|

| — |

|

| — |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peter Rust |

| 2008 |

|

| 8,600 |

|

| — |

|

| 3,738 |

|

| 12,338 |

|

(3)

Non-employee directors receive options to acquire 1,000 shares of common stock for attending each Board of Director meeting and options to acquire 500 shares of common stock for attending each committee meeting. The options are fully vested when granted. The amounts included in the “Option Awards” column represent the compensation cost we recognized in 20062008 related to option awards, as described in Statement of Financial Accounting Standards No. 123R without taking into account any forfeiture rates.123R. For a discussion of the valuation assumptions, see Note 132 to our consolidated financial statements included in ourthis Annual Report on Form 10-K for the fiscal year ended December 31, 2006.2008. In 2008, we used the following weighted average assumptions to determine the fair value of option awards: a risk-free interest rate of 2.9%, an expected life of five years, expected volatility of 97.0%, an estimated forfeiture rate of 0% and no dividends. Please see the “Grants of Plan-Based Awards” table for more information regarding option awards we granted in 2006.

Contacting The Board Of Directors

Any stockholder who desires to contact our board of directors, committees of the board of directors and individual directors may do so by writing to:

Glowpoint, Inc., [Addressee], 225 Long Avenue, Hillside, New Jersey 07205

·

Audit Committee of the Board of Directors

·

Compensation Committee of the Board of Directors

·

Nominating Committee of the Board of Directors

·

Name of individual directors

These communications are sent by us directly to the specified addressee.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The information contained in this Audit Committee Report is not “soliciting material” and has not been “filed” with the Securities and Exchange Commission. This Audit Committee Report will not be incorporated by reference into any of our future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we may specifically incorporate it by reference into a future filing.

The audit committee is composed of three members and one alternate member.members. Each member is a director who meets the current independence standards under the applicable SEC and AmEx rules. The audit committee operates under a written audit committee charter. As described more fully in its charter, the purpose of the audit committee is to assist the board in its general oversight of Glowpoint’s financial reporting, internal controls and audit functions. Management is responsible for the preparation, presentation and integrity of Glowpoint’s financial statements; accounting and financial reporting principles; internal controls; and procedures designed to reasonably assure compliance with accounting standards, applicable laws and regulations. Amper, Politziner & Mattia, P.C.LLP (“Amper”), our Independent Registered Public Accounting Firm, is responsible for performing an independent audit of the consolidated financial statements in accordance with the Standards of the Public Company Accounting Oversight Board (United States). In accordance with law, the audit committee has ultimate authority and responsibility to select, compensate, evaluate and, when appropriate, replace our Independent Registered Public Accounting Firm. The audit committee has the authority to engage its own outside advisers, including experts in particular areas of accounting, as it determines appropriate, apart from counsel or advisers hired by management.

The audit committee members may not be professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the Independent Registered Public Accounting Firm, nor can the audit committee certify that the Independent Registered Public Accounting Firm is “independent” under applicable rules. The audit committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and the Independent Registered Public Accounting Firm on the basis of the information it receives, discussions with management and the Independent Registered Public Accounting Firm, and the experience of the audit committee’s members in business, financial and accounting matters. Each member of the audit committee has been determined by the board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules. StockholdersStoc kholders should understand that this designation is an SEC disclosure requirement related to these directors’ experience and understanding with respect to certain accounting and auditing matters. The designation does not impose on these directors any duties, obligations or liability that are greater than are generally imposed on them as a member of the audit committee and the board, and their designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the audit committee or the board.

In accordance with law, the audit committee is responsible for establishing procedures for the receipt, retention and treatment of complaints received by Glowpoint regarding accounting, internal accounting controls or auditing matters, including the confidential, anonymous submission by our employees, received through established procedures, of concerns regarding questionable accounting or auditing matters.

Among other matters, the audit committee monitors the activities and performance of Glowpoint’s Independent Registered Public Accounting Firm, including the audit scope, external audit fees, Independent Registered Public Accounting Firm independence matters and the extent to which the Independent Registered Public Accounting Firm may be retained to perform non-audit services.

In accordance with audit committee policy and the requirements of law, all services to be provided by Amper are pre-approved by the audit committee. Pre-approval includes audit services, audit-related services, tax services and other services. To avoid certain potential conflicts of interest, the law prohibits a publicly-traded company from obtaining certain non-audit services from its Independent Registered Public Accounting Firm. We obtain these services from other service providers as needed.

The audit committee has reviewed our audited financial statements and met and held discussions with management regarding the audited financial statements. Management has represented to the audit committee that our consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States.

The audit committee has discussed with Amper, our Independent Registered Public Accounting Firm, the matters required to be discussed by Statement of Auditing Standards No. 61 (Communication with Audit Committees). These discussions have included a review as to the quality, not just the acceptability, of our accounting principles.

Our Independent Registered Public Accounting Firm also provided to the audit committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), and the audit committee discussed with the Independent Registered Public Accounting Firm its independence from management and our

company. The audit committee has also considered the compatibility of non-audit services with the Independent Registered Public Accounting Firm’s independence.

Based on the audit committee’s discussion with management and the Independent Registered Public Accounting Firm, the audit committee’s review of the audited financial statements, the representations of management and the report of the Independent Registered Public Accounting Firm to the audit committee, the audit committee recommended that the board of directors file the audited consolidated financial statements for the year ended December 31, 20062008 with the SEC on Form 10-K.

Respectfully submitted, | |

James Lusk,Chairman Bami Bastani Peter Rust | |

COMPENSATION DISCUSSION AND ANALYSIS

General Compensation Philosophy

Our overall compensation philosophy is to provide a total compensation package that is competitive and enables us to attract, motivate, reward and retain key executives and other employees who have the skills and experience necessary to promote our short- and long-term financial performance and growth.

The Compensation Committee recognizes the critical role of our executive officers in our growth, success and in our future prospects. Accordingly, our executive compensation policies are designed to (1) align the interests of executive officers with those of stockholders by encouraging stock ownership by executive officers and by making a significant portion of executive compensation dependent on our financial performance, (2) provide compensation that will attract and retain talented professionals, (3) reward individual results through base salary, annual cash bonuses, long-term incentive compensation in the form of stock options, restricted stock awards and various other benefits, and (4) manage compensation based on skill, knowledge, effort and responsibility needed to perform a particular job successfully.

In establishing salary, bonuses and long-term incentive compensation for our executive officers, the Compensation Committee takes into account both the position and the expertise of a particular executive, as well as the Committee’s understanding of competitive compensation for similarly situated executives in our sector of the technology industry. Michael Brandofino,Each of our President and ChiefCo-Chief Executive Officer,Officers confers with members of the Compensation Committee, and makes recommendations, regarding the compensation of all executive officers other than himself. He does not participatehim. Neither Co-Chief Executive Officer, however, participates in the Compensation Committee's deliberations regarding his own compensation. In determining the compensation of our executive officers, the Compensation Committee may consult available compensation reports, but does notand at its sole discretion may engage in any benchmarking of total compensation or any material element of compensation and does not retain anyretaining a compensation consultant or expert.

Components of Compensation

The components of the compensation program for named executive officers are described below.

Base Salary

. Salaries for executive officers forThe base salaries for the named executive officers for 20062008 were increased from the 20052007 levels pursuant to an employment agreement or in accordance with our company policy and past practice.

Bonus/Incentive Compensation

. The Compensation Committee believes that a substantial portion of the annual compensation of each executive officer should be in the form of variable cash incentive pay. Accordingly, we did not award a guaranteed bonus to any executive officer inThe Compensation Committee approved a cashdid not award any bonus to the named executive officers for 2006 based upon meeting certain performance targets, which included, without limitation, various company objectives (for example, targets associated with revenue, cost2008. Mr. Laezza did, however, receive $15,000, in lieu of revenue and improvementany payments due under our sales commission plan, for new business he originated in other key financial metrics) and various personal objectives. Additionally, each named executive officer other than Mr. Robinson, who was not employed by us at the time, received a cash retention bonus in 2006 as part of a companywide retention program implemented with the March 2006 restructuring.

Long-Term Incentive Awards

. The Compensation Committee believes that equity-based compensation in the form of stock options or restricted stock links the interests of executives with the long-term interests of our stockholders and encourages executives to remain in our employ. We grant stock options in accordance with our various stock option plans. Grants of options and/or restricted stock are awarded based on a number of factors, including the individual’s level of responsibility, the amount and term of options already held by the individual, the individual’s contributions to the achievement of our financial and strategic objectives, and industry practices and norms.Broad-based Employee Benefits

. As employees, our named executive officers have the opportunity to participate in a number of benefits programs that are generally available to all eligible employees. These benefits include:·

Healthcare Plans – includes medical benefits, dental benefits, and vision care program.

·

401(k) Retirement Plan – allows eligible employees to save for retirement on a tax-advantaged basis. Under the 401(k) Plan, participants may elect to defer a portion of their compensation on a pre-tax basis and have it contributed to the Plan subject to applicable annual Internal Revenue Code limits. Pre-tax contributions are allocated to each participant's individual account and are then invested in selected investment alternatives according to the participants' directions. Employee elective deferrals are 100% vested at all times. The 401(k) Plan allows for matching contributions to be made by us. As a tax-qualified retirement plan, contributions to the 401(k) Plan and earnings on those contributions are not taxable to the employees until distributed from the 401(k) Plan and all contributions are deductible by us when made.

Compensation Committee Report

The information contained in this Compensation Committee Report is not “soliciting material” and has not been “filed” with the Securities and Exchange Commission. This Compensation Committee Report will not be incorporated by reference into any of our future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we may specifically incorporate it by reference into a future filing.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis section appearing above with Glowpoint’s management. Based on this review and these discussions, the Compensation Committee recommended to Glowpoint’s board of directors that the Compensation Discussion and Analysis be included in this proxy statement.

Respectfully submitted,

Bami Bastani

Dean Hiltzik

James Lusk

EXECUTIVE COMPENSATION AND OTHER MATTERS

Summary Compensation Table

The table set forth below summarizes for our named executive officers the compensation paid, accrued or granted, during or with respect to the yeartwo years ended December 31, 2006.2008. Certain columnar information required by Item 402(c)(2) of Regulation S-K has been omitted for categories where there has been no compensation awarded to, or paid to, the named executive officers during or with respect to the yeartwo years ended December 31, 2006.

Name and Principal Position | Year (1) | Salary | Bonus | Stock Awards (2) | Option Awards (3) | All Other Compensation (4) | Total | |||||||||||||||

Michael Brandofino President and Chief Executive Officer | 2006 | $ | 267,500 | $ | 27,500 | $ | - | $ | 26,969 | $ | 10,279 | $ | 332,248 | |||||||||

Edwin F. Heinen Chief Financial Officer | 2006 | 167,212 | 37,500 | - | 71,157 | 5,056 | 280,925 | |||||||||||||||

Joseph Laezza Chief Operating Officer | 2006 | 228,608 | 23,320 | 35,384 | 34,459 | 3,900 | 325,671 | |||||||||||||||

David W. Robinson Executive Vice President, General Counsel | 2006 | 158,769 | 16,080 | 41,000 | 9,882 | 2,140 | 227,871 | |||||||||||||||

David Trachtenberg Former President and Chief Executive Officer | 2006 | 129,808 | - | 124,000 | - | 693,892 | 947,700 | |||||||||||||||

Gerard Dorsey Former Chief Financial Officer | 2006 | 65,962 | - | - | 10,739 | 138,927 | 215,628 | |||||||||||||||

Name and Principal Position |

| Year |

| Salary |

| Bonus |

| Stock Awards (1) |

| Option Awards (2) |

| All Other Compensation (3) |

| Total |

| |||||||

Edwin F. Heinen Chief Financial Officer |

|

| 2008 |

| $ | 211,523 |

| $ | — |

| $ | 79,552 |

| $ | 33,398 |

| $ | 7,072 |

| $ | 331,546 |

|

|

|

| 2007 |

|

| 200,769 |

|

| 63,000 | (4) |

| 79,222 |

|

| 54,543 |

|

| 8,695 |

|

| 406,229 |

|

Joseph Laezza Co-Chief Executive Officer and President |

|

| 2008 |

|

| 256,067 |

|

| 15,000 | (5) |

| 55,219 |

|

| 29,242 |

|

| 6,455 |

|

| 361,984 |

|

|

|

| 2007 |

|

| 242,976 |

|

| 63,000 | (4) |

| 61,971 |

|

| 92,812 |

|

| 7,563 |

|

| 468,322 |

|

David W. Robinson Co-Chief Executive Officer, Executive Vice President, General Counsel |

|

| 2008 |

|

| 262,322 |

|

| — |

|

| 63,219 |

|

| 26,167 |

|

| 7,265 |

|

| 358,973 |

|

|

|

| 2007 |

|

| 248,861 |

|

| 63,000 | (4) |

| 66,000 |

|

| 27,864 |

|

| 8,205 |

|

| 413,930 |

|

Michael Brandofino Former Chief Executive Officer |

|

| 2008 |

|

| 277,115 |

|

| — |

|

| 107,969 |

|

| 21,786 |

|

| 8,421 |

|

| 415,291 |

|

|

|

| 2007 |

|

| 276,058 |

|

| 84,000 | (4) |

| 77,500 |

|

| 73,471 |

|

| 9,608 |

|

| 520,637 |

|

(1) In accordance with SEC transition rules, information is provided for the most recently completed fiscal year only.

The amounts included in the “Stock Awards” column represent the compensation cost we recognized in 20062008 and 2007 related to non-option stock awards, as described in Statement of Financial Accounting Standards No. 123R without taking into account any forfeiture rates. For a discussion ofWe value the valuation assumptions, see Note 13 to our consolidated financial statements included in our Annual Reportnon-option stock award using the common stock price on Form 10-K for the fiscal year ended December 31, 2006.grant date. Please see the “Grants of Plan-Based Awards” table for more information regarding stock awards we granted in 2006.2008 and 2007. The table below summarizes, by year of grant, the 20062008 and 2007 expense amounts, respectively, reported in the “Stock Awards” column for each named executive officer:

Name | 2003 | 2004 | 2005 | 2006 | Total | |||||||||||

| Joseph Laezza | $ | - | $ | 35,384 | $ | - | $ | - | $ | 35,384 | ||||||

| David W. Robinson | - | - | - | 41,000 | 41,000 | |||||||||||

| David Trachtenberg | 124,000 | - | - | - | 124,000 | |||||||||||

Name |

| Year |

| 2004 |

| 2005 |

| 2006 |

| 2007 |

| 2008 |

| Total |

| |||||||

Edwin F. Heinen |

|

| 2008 |

| $ | — |

| $ | — |

| $ | — |

| $ | 37,334 |

| $ | 42,219 |

| $ | 79,553 |

|

|

|

| 2007 |

|

| — |

|

| — |

|

| — |

|

| 79,222 |

|

| — |

|

| 79,222 |

|

Joseph Laezza |

|

| 2008 |

|

| — |

|

| — |

|

| — |

|

| 13,000 |

|

| 42,219 |

|

| 55,219 |

|

|

|

| 2007 |

|

| 8,846 |

|

| — |

|

| — |

|

| 53,125 |

|

| — |

|

| 61,971 |

|

David W. Robinson |

|

| 2008 |

|

| — |

|

| — |

|

| 21,000 |

|

| — |

|

| 42,219 |

|

| 63,219 |

|

|

|

| 2007 |

|

| — |

|

| — |

|

| 21,000 |

|

| 45,000 |

|

| — |

|

| 66,000 |

|

Michael Brandofino |

|

| 2008 |

|

| — |

|

| — |

|

| — |

|

| 52,000 |

|

| 52,969 |

|

| 107,969 |

|

|

|

| 2007 |

|

| — |

|

| — |

|

| — |

|

| 77,500 |

|

| — |

|

| 77,500 |

|

(2)

The amounts included in the “Option Awards” column represent the compensation cost we recognized in 20062008 and 2007 related to option awards, as described in Statement of Financial Accounting Standards No. 123R without taking into account any forfeiture rates.123R. For a discussion of the valuation assumptions, see Note 132 to our consolidated financial statements included in ourthis Annual Report on Form 10-K for the fiscal year ended December 31, 2006.2008. In 2008, we used the following weighted average assumptions to determine the fair value of the option awards: a risk-free interest rate of 2.9%, an expected life of five years, expected volatility of 97.0%, an estimated forfeiture rate of 10% and no dividends. Please see the “Grants of Plan-Based Awards” table for more information regarding option awards we granted in 2006.2008 and 2007. The following table summarizes, by year of grant, the 20062008 and 2007 expense amounts, respectively, reported in the “Option Awards”Awards& #148; column for each named executive officer:

Name | 2004 | 2005 | 2006 | Total | |||||||||

| Michael Brandofino | $ | 17,087 | $ | - | $ | 9,882 | $ | 26,969 | |||||

| Edwin F. Heinen | - | 61,275 | 9,882 | 71,157 | |||||||||

| Joseph Laezza | - | 24,577 | 9,882 | 34,459 | |||||||||

| David W. Robinson | - | - | 9,882 | 9,882 | |||||||||

| David Trachtenberg | - | - | - | - | |||||||||

| Gerard Dorsey | 10,739 | - | - | 10,739 | |||||||||

Name |

| Year |

| 2004 |

| 2005 |

| 2006 |

| 2007 |

| 2008 |

| Total |

| |||||||

Edwin F. Heinen |

|

| 2008 |

| $ | — |

| $ | 7,231 |

| $ | 5,816 |

| $ | 20,351 |

| $ | — |

| $ | 33,398 |

|

|

|

| 2007 |

|

| — |

|

| 26,679 |

|

| 13,333 |

|

| 14,531 |

|

| — |

|

| 54,543 |

|

Joseph Laezza |

|

| 2008 |

|

| — |

|

| 3,463 |

|

| 5,816 |

|

| 19,963 |

|

| — |

|

| 29,242 |

|

|

|

| 2007 |

|

| — |

|

| 10,869 |

|

| 13,333 |

|

| 68,610 |

|

| — |

|

| 92,812 |

|

David W. Robinson |

|

| 2008 |

|

| — |

|

| — |

|

| 5,816 |

|

| 20,351 |

|

| — |

|

| 26,167 |

|

|

|

| 2007 |

|

| — |

|

| — |

|

| 13,333 |

|

| 14,531 |

|

| — |

|

| 27,864 |

|

Michael Brandofino |

|

| 2008 |

|

| — |

|

| — |

|

| 5,816 |

|

| 15,970 |

|

| — |

|

| 21,786 |

|

|

|

| 2007 |

|

| 5,250 |

|

| — |

|

| 13,333 |

|

| 54,888 |

|

| — |

|

| 73,471 |

|

(PRELIMINARY COPY3)

The following table presents all other compensation during the yearyears ended December 31, 20062008 and 2007 to the named executive officers:

Name | Year (1) | Vehicle Allowance | Company Contributions to 401(k) Plan | Health Insurance | Severance (5) | Total | |||||||||||||

| Michael Brandofino | 2006 | $ | 4,000 | $ | 3,132 | $ | 3,147 | $ | - | $ | 10,279 | ||||||||

| Edwin F. Heinen | 2006 | 3,700 | 1,356 | - | - | 5,056 | |||||||||||||

| Joseph Laezza | 2006 | 3,900 | - | - | - | 3,900 | |||||||||||||

| David W. Robinson | 2006 | 2,140 | - | - | - | 2,140 | |||||||||||||

| David Trachtenberg | 2006 | 6,772 | 1,438 | 4,612 | 681,070 | 693,892 | |||||||||||||

| Gerard Dorsey | 2006 | 1,400 | 1,923 | - | 135,604 | 138,927 | |||||||||||||

Name |

| Year (1) |

| Vehicle |

| Company |

| Health |

| Severance |

| Total |

| |||||

Edwin F. Heinen |

| 2008 |

| $ | 4,840 |

| $ | 2,232 |

| $ | — |

| $ | — |

| $ | 7,072 |

|

|

| 2007 |

|

| 4,820 |

|

| 3,875 |

|

| — |

|

| — |

|

| 8,695 |

|

Joseph Laezza |

| 2008 |

|

| 4,840 |

|

| 1,615 |

|

| — |

|

| — |

|

| 6,455 |

|

|

| 2007 |

|

| 4,820 |

|

| 2,743 |

|

| — |

|

| — |

|

| 7,563 |

|

David W. Robinson |

| 2008 |

|

| 4,840 |

|

| 2,425 |

|

| — |

|

| — |

|

| 7,265 |

|

|

| 2007 |

|

| 4,820 |

|

| 3,385 |

|

| — |

|

| — |

|

| 8,205 |

|

Michael Brandofino |

| 2008 |

|

| 4,840 |

|

| 3,581 |

|

| — |

|

| — |

|

| 8,421 |

|

|

| 2007 |

|

| 4,820 |

|

| 3,214 |

|

| 1,574 |

|

| — |

|

| 9,608 |

|

(4)

The following table presentsreported bonus consists of a combination of restricted stock and cash. Mr. Brandofino was awarded 100,000 shares of restricted stock, which had a dollar value of $55,000 on the severance benefits duringdate of grant, and the year ended December 31, 2006balance of the bonus (which is $29,000) was paid in cash. Each of Messrs. Laezza, Heinen, and Robinson was awarded 75,000 shares of restricted stock, which had a dollar value of $41,250 on the date of grant, and the balance of the bonus (which is $21,750) was paid in cash.

(5)

The reported amount was paid in cash to the named executive officers:

Name | Year (1) | Accelerated Vesting of Stock Awards | Accelerated Vesting of Option Awards | Extension of Post Termination Option Exercise Period | Health Insurance | Severance | Total | |||||||||||||||

| David Trachtenberg | 2006 | $ | 170,500 | $ | - | $ | 826 | $ | 9,744 | $ | 500,000 | $ | 681,070 | |||||||||

| Gerard Dorsey | 2006 | - | 9,353 | 1,150 | - | 125,101 | 135,604 | |||||||||||||||

Grants of Plan-Based Awards

The table set forth below presents all plan-based equity and non-equity grants made by Glowpoint during the yearyears ended December 31, 20062008 and 2007 to the named executive officers. Certain columnar information required by Item 402(c)402(d)(2) of Regulation S-K has been omitted for categories where there has been no compensation awarded to, or paid to, the named executive officers during or with respect to the yearyears ended December 31, 2006.

Name | Grant Date | All Other Stock Awards: Number of Shares of Stock or Units (#) | All Other Awards: Number of Securities Underlying Options (#) (1) | Exercise or Base Price of Option Awards ($/sh) | Grant Date Fair Value of Stock and Option Awards | |||||||||||

| Michael Brandofino | 6/27/06 | - | 100,000 | $ | 0.41 | $ | 30,638 | |||||||||

| Edwin F. Heinen | 6/27/06 | - | 100,000 | $ | 0.41 | 30,638 | ||||||||||

| Joseph Laezza | 6/27/06 | - | 100,000 | $ | 0.41 | 30,638 | ||||||||||

| David W. Robinson | 5/4/06 | 200,000 (2 | ) | - | - | 90,000 | ||||||||||

| 6/27/06 | - | 100,000 | $ | 0.41 | 30,638 | |||||||||||

| David Trachtenberg | - | - | - | - | - | |||||||||||

| Gerard Dorsey | - | - | - | - | - | |||||||||||

Name |

| Grant Date |

| All Other Stock Awards: Number of Shares of Stock or |

| All Other Awards: Number of Securities Underlying Options (#) |

| Exercise or Base Price of Option Awards ($/sh) |

| Grant Date Fair Value of Stock and Option Awards |

| ||||

Edwin F. Heinen |

| 10/24/08 |

|

| 50,000 | (10) |

| — |

| $ | — |

| $ | 15,500 |

|

|

| 3/10/08 |

|

| 75,000 | (8) |

| — |

|

| — |

|

| 41,250 |

|

|

| 6/25/07 |

|

| — |

|

| 100,000 | (1) |

| 0.60 |

|

| 46,272 |

|

|

| 6/25/07 |

|

| 75,000 | (4) |

| — |

|

| — |

|

| 45,000 |

|

|

| 1/30/07 |

|

| 200,000 | (7) |

| — |

|

| — |

|

| 112,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Joseph Laezza |

| 10/24/08 |

|

| 50,000 | (10) |

| — |

|

| — |

|

| 15,500 |

|

|

| 3/10/08 |

|

| 75,000 | (8) |

| — |

|

| — |

|

| 41,250 |

|

|

| 6/25/07 |

|

| 75,000 | (4) |

| — |

|

| — |

|

| 45,000 |

|

|

| 5/15/07 |

|

| 100,000 | (6) |

| — |

|

| — |

|

| 52,000 |

|

|

| 5/15/07 |

|

| — |

|

| 250,000 | (3) |

| 0.52 |

|

| 99,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

David W. Robinson |

| 10/24/08 |

|

| 50,000 | (10) |

| — |

|

| — |

|

| 15,500 |

|

|

| 3/10/08 |

|

| 75,000 | (8) |

| — |

|

| — |

|

| 41,250 |

|

|

| 6/25/07 |

|

| — |

|

| 100,000 | (1) |

| 0.60 |

|

| 46,272 |

|

|

| 6/25/07 |

|

| 75,000 | (4) |

| — |

|

| — |

|

| 45,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Michael Brandofino |

| 10/24/08 |

|

| 50,000 | (10) |

| — |

|

| — |

|

| 15,500 |

|

|

| 3/10/08 |

|

| 100,000 | (9) |

| — |

|

| — |

|

| 55,000 |

|

|

| 6/25/07 |

|

| 75,000 | (4) |

| — |

|

| — |

|

| 45,000 |

|

|

| 5/15/07 |

|

| — |

|

| 200,000 | (2) |

| 0.52 |

|

| 79,388 |

|

|

| 5/15/07 |

|

| 400,000 | (5) |

| — |

|

| — |

|

| 208,000 |

|

————��——

(1)

The options for each of the named executive officers to purchase 100,000 shares were granted on June 27, 2006,25, 2007, have a ten year life and vests as to 33.33% of the total number of shares subject to the grant on each of the first, second and third anniversary dates of the grant.

(2) A restricted stock award of

Options to purchase 200,000 shares waswere granted on May 4, 2006,15, 2007, have a ten year life and vestedvests as to 60,000 shares on the commencement date of Mr. Robinson’s employment. The remaining 140,000100,000 shares subject to the grant vestson that date and as to the remaining 100,000 shares subject to the grant, 33.33% on each of the first, second and third anniversary dates of the grant.

(3)

Options to purchase 250,000 shares were granted on May 15, 2007, have a ten year life and vests as to 125,000 shares subject to the grant on that date and as to the remaining 125,000 shares subject to the grant, 33.33% on each of the first, second and third anniversary dates of the grant.

(4)

Restricted stock awards for each of the named officers of 75,000 shares were granted on June 25, 2007 and vested on the date of the grant.

(5)

A restricted stock award of 400,000 shares was granted on May 15, 2007, and vests as to 50% of the total number of shares subject to the grant on each of the second and fourth anniversary dates of the grant. On March 20, 2009, the grant was cancelled and replaced with a grant of 400,000 shares which vest upon the earlier of a change in control and the second anniversary of the grant. The grant date fair value of this new grant was $136,000.

(6)

A restricted stock award of 100,000 shares was granted on May 15, 2007, and vests as to 50% of the total number of shares subject to the grant on each of the second and fourth anniversary dates of the grant.

(7)

A restricted stock award of 200,000 shares was granted on January 30, 2007, and vests as to 33.33% of the total number of shares subject to the grant on each of the first, second and third anniversary dates of the grant.

(8)

Restricted stock awards for each of the named officers of 75,000 shares were granted on March 10, 2008 and vested on the date of the grant.

(9)

A restricted stock award of 100,000 shares was granted on March 10, 2008 and vested on the date of the grant.

(10)

Restricted stock awards for each of the named officers of 50,000 shares were granted on October 24, 2008, and vests as to 33.33% of the total number of shares subject to the grant on each of the first, second and third anniversary dates of the grant. The grant of 50,000 shares to Mr. Brandofino was cancelled on March 20, 2009.

Employment Agreements

We have entered into employment agreements with our executive officers. Additional information as to the terms of the employment agreements is set forth in our 20062008 Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission on June 6, 2007March 31, 2009 and is attached hereto. Such information is subject to the detailed provisions of the respective agreements attached as exhibits to our filings with the Securities and Exchange Commission.

Outstanding Equity Awards at Fiscal Year-End

The table set forth below presents the number and values of exercisable and unexercisable options and unvested restricted stock at December 31, 2006.2008. Certain columnar information required by Item 402(c)402(f)(2) of Regulation S-K has been omitted for categories where there has been no compensation awarded to, or paid to, the named executive officers required to be reported in the table during two fiscal yearyears ended December 31, 2006.

Option Awards | Stock Awards | ||||||||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) (5) | |||||||||||||

| Michael Brandofino | 100,000 | - | $ | 3.94 | 1/01/2011 | - | $ | - | |||||||||||

| 20,000 | - | 4.40 | 2/25/2012 | - | - | ||||||||||||||

| 15,000 | - | 3.04 | 4/24/2012 | - | - | ||||||||||||||

| 29,875 | - | 1.13 | 7/22/2012 | - | - | ||||||||||||||

| 100,000 | - | 3.39 | 9/23/2013 | - | - | ||||||||||||||

| 75,000 | 25,000 (1 | ) | 1.36 | 7/26/2014 | - | - | |||||||||||||

| - | 100,000 (2 | ) | 0.41 | 6/27/2016 | - | - | |||||||||||||

| Edwin F. Heinen | 13,333 | 26,667 (3 | ) | 2.13 | 3/02/2015 | - | - | ||||||||||||

| 4,667 | 9,333 (3 | ) | 1.17 | 8/10/2015 | - | - | |||||||||||||

| 25,000 | 50,000 (3 | ) | 1.00 | 9/29/2015 | - | - | |||||||||||||

| - | 100,000 (2 | ) | 0.41 | 6/27/2016 | - | - | |||||||||||||

| Joseph Laezza | 16,667 | 33,333 (4 | ) | 1.17 | 8/10/2015 | - | - | ||||||||||||

| - | 100,000 (2 | ) | 0.41 | 6/27/2016 | - | - | |||||||||||||

| - | - | - | - | 18,334 (6 | ) | 6,967 | |||||||||||||

| David W. Robinson | - | 100,000 (2 | ) | 0.41 | 6/27/2016 | - | - | ||||||||||||

| - | - | - | 140,000 (7 | ) | 53,200 | ||||||||||||||

|

| Option Awards |

| Stock Awards |

| ||||||||||||||

Name |

| Number of |

| Number of |

| Option |

| Option |

| Number |

| Market Value of Shares or |

| ||||||

Edwin F. Heinen |

|

| 40,000 |

|

| — |

| $ | 2.13 |

|

| 3/02/2015 |

|

| — |

| $ | — |

|

|

|

| 14,000 |

|

| — |

|

| 1.17 |

|

| 8/10/2015 |

|

| — |

|

| — |

|

|

|

| 75,000 |

|

| — |

|

| 1.00 |

|

| 9/29/2015 |

|

| — |

|

| — |

|

|

|

| 66,666 |

|

| 33,334 | (1) |

| 0.41 |

|

| 6/27/2016 |

|

| — |

|

| — |

|

|

|

| 33,333 |

|

| 66,667 | (2) |

| 0.60 |

|

| 6/25/2017 |

|

| — |

|

| — |

|

|

|

| — |

|

| — |

|

| — |

|

| — |

|

| 133,333 | (7) |

| 40,000 |

|

|

|

| — |

|

| — |

|

| — |

|

| — |

|

| 50,000 | (10) |

| 15,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Joseph Laezza |

|

| 50,000 |

|

| — |

|

| 1.17 |

|

| 8/10/2015 |

|

| — |

|

| — |

|

|

|

| 66,666 |

|

| 33,334 | (1) |

| 0.41 |

|

| 6/27/2016 |

|

| — |

|

| — |

|

|

|

| 166,667 |

|

| 83,333 | (4) |

| 0.52 |

|

| 5/15/2017 |

|

| — |

|

| — |

|

|

|

| — |

|

| — |

|

| — |

|

| — |

|

| 100,000 | (8) |

| 30,000 |

|

|

|

| — |

|

| — |

|

| — |

|

| — |

|

| 50,000 | (10) |

| 15,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

David W. Robinson |

|

| 66,666 |

|

| 33,334 | (1) |

| 0.41 |

|

| 6/27/2016 |

|

| — |

|

| — |

|

|

|

| 33,333 |

|

| 66,667 | (2) |

| 0.60 |

|

| 6/25/2017 |

|

| — |

|

| — |

|

|

|

| — |

|

| — |

|

| — |

|

| — |

|

| 46,666 | (9) |

| 14,000 |

|

|

|

| — |

|

| — |

|

| — |

|

| — |

|

| 50,000 | (10) |

| 15,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Michael Brandofino |

|

| 100,000 |

|

| — |

|

| 3.94 |

|

| 1/01/2011 | (11) |